U.S. stocks gain ground as investors shrug off Mideast concerns

Lola Evans

24 Jun 2025, 01:37 GMT+10

- Investors and traders were comforted by the Iranian retaliation.

- Monday’s foreign exchange market saw the U.S. dollar trade unevenly against major currencies, with the euro and British pound posting notable gains.

- The FTSE 100 (^FTSE) in London dipped slightly, closing at 8,758.04, down 16.61 points or 0.19 percent.

NEW YORK, New York - U.S. stocks made strong gains on Monday, brushing off concerns Donald Trump's surprise ambush of Iranian nuclear sites at Fordo, Isfahan and Natanz on the weekend could lead to an all-out regional war in the Middle East.

Investors and traders were comforted by the Iranian retaliation. Limited strikes on U.S. bases in Qatar and Iraq, caused no deaths or injuries and did little damage. Qatar announced it had successfully intercepted most of the limited barrage.

The Standard and Poor's 500 (^GSPC) led the charge on Wall Street, rising 57.33 points or 0.96 percent to close at 6,025.17, marking its highest level in recent weeks.

The Dow Jones Industrial Average (^DJI) also saw strong gains, adding 374.96 points or 0.89 percent to finish at 42,581.78, while the tech-heavy NASDAQ Composite (^IXIC) advanced 183.56 points or 0.94 percent to 19,630.97.

Trading volumes were robust, with the S&P 500 recording 3.167 billion shares traded, the Dow Jones seeing 486.542 million, and the NASDAQ logging 7.767 billion in volume.

Dollar Shows Mixed Performance, Euro and Pound Gain Ground, Yen Weakens

Monday's foreign exchange market saw the U.S. dollar trade unevenly against major currencies, with the euro and British pound posting notable gains while the Swiss franc edged up only slightly.

Key Currency Movements

The euro (EUR/USD) rose 0.44 percent to 1.1571, marking its strongest level in recent sessions. The British pound (GBP/USD) also climbed 0.56 percent to 1.3523, supported by improved risk sentiment in European markets.

The U.S. dollar (USD/CHF) fell sharply against the Swiss franc, dropping 0.63 percent to 0.8120, as traders sought safe-haven assets amid Middle East tensions.

Dollar Holds Steady Against Yen and Canadian Dollar

The U.S. dollar (USD/JPY) inched up 0.08 percent to 146.18 against the Japanese yen,. Meanwhile, the greenback (USD/CAD) was nearly flat against the Canadian dollar, edging up just 0.01 percent to 1.3733 as oil price fluctuations kept the Canadian dollar in check.

Commodity Currencies Edge Higher

The Australian dollar (AUD/USD) gained 0.12 percent to 0.6453, while the New Zealand dollar (NZD/USD) advanced 0.22 percent to 0.5971, supported by improved risk appetite in Asian trading.

Global Markets Close Mixed on Monday; European and Asian Indices Show Divergence

Monday's trading session saw mixed performances across global stock indices despite the sudden and violent attacks by the United States on Iran on Saturday night, with European markets mostly in the red while select Asian indices posted gains.

Canadian Markets

North of the U.S. border, Canada's S&P/TSX Composite (^GSPTSE) also closed higher, gaining 111.79 points or 0.42 percent to settle at 26,609.36, with 308.166 million shares traded. The index was supported by strength in energy and financial sectors.

UK and European Markets

The FTSE 100 (^FTSE) in London dipped slightly, closing at 8,758.04, down 16.61 points or 0.19 percent.

Germany's DAX (^GDAXI) fell 81.54 points or 0.35 percent to 23,269.01, while France's CAC 40 (^FCHI) dropped 52.09 points or 0.69 percent to 7,537.57.

The broader EURO STOXX 50 (^STOXX50E) declined 11.68 points or 0.22 percent to 5,221.90, and the Euronext 100 (^N100) slipped 3.23 points or 0.21 percent to 1,555.79. Belgium's BEL 20 (^BFX) was a rare bright spot, edging up 2.45 points or 0.06 percent to 4,441.98.

Asian Markets

Hong Kong's Hang Seng Index (^HSI) rose 158.65 points or 0.67 percent to 23,689.13, while China's Shanghai Composite (000001.SS) gained 21.69 points or 0.65 percent to 3,381.58. Malaysia's KLSE (^KLSE) climbed 13.87 points or 0.92 percent to 1,516.61.

However, other Asian markets struggled. Japan's Nikkei 225 (^N225) slipped 49.14 points or 0.13 percent to 38,354.09, and South Korea's KOSPI (^KS11) lost 7.37 points or 0.24 percent to 3,014.47. India's Sensex (^BSESN) dropped sharply by 511.38 points or 0.62 percent to 81,896.79, while Taiwan's TWSE (^TWII) tumbled 313.72 points or 1.42 percent to 21,732.02.

Pacific & Middle East

Australia's S&P/ASX 200 (^AXJO) fell 30.60 points or 0.36 percent to 8,474.90, and the All Ordinaries (^AORD) declined 35.50 points or 0.41 percent to 8,688.00.

New Zealand's NZX 50 (^NZ50) dipped 36.40 points or 0.29 percent to 12,532.65.

In the Middle East, Egypt's EGX 30 (^CASE30) surged 362.70 points or 1.17 percent to 31,418.70, while Israel's TA-125 (^TA125.TA) dropped 38.61 points or 1.32 percent to 2,881.01.

Looking Ahead

Investors remain cautious amid geopolitical tensions and uncertainty over what will happen next in the U.S.-Israel-Iran conflict. The mixed performance across regions suggests a lack of clear directional momentum as markets await further Mideast developments,, and key economic data later in the week.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionNew Zealand PM seeks stronger ties with China amid security talks

BEIJING/WELLINGTON: New Zealand's Prime Minister Christopher Luxon commenced his visit to China on June 17, seeking to strengthen trade...

KL Rahul continues rich SENA run, overtakes Dravid with third Test ton as opener in England

Leeds [UK], June 23 (ANI): Indian opener KL Rahul continued his brilliant run in South Africa, England, New Zealand and Australia (SENA)...

Top shooters of the country to feature in National Selection Trials 3 and 4

Dehradun (Uttarakhand) [India], July 23 (ANI): India's top shooters will be seen in action as the National Selection Trials 3 and 4...

India achieve unique first-time feat following brilliant batting exhibition at Leeds

Leeds [UK], June 23 (ANI): The Indian team made a historic record during their Leeds Test against England, as for the first time, they...

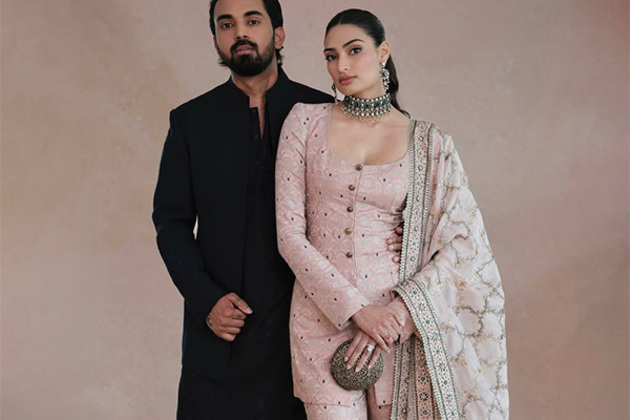

"This one is special": Athiya Shetty gives shout-out to husband KL Rahul as he slams 9th Test Century

Mumbai (Maharashtra) [India], June 23 (ANI): Actor Athiya Shetty has praised her husband and cricketer KL Rahul for his 9th Test Century....

Trump urges petroleum producers to keep oil prices down

The presidents call comes after Iran threatened to block the Strait of Hormuz, a key trade route for crude US President Donald Trump...

Business

SectionU.S. stocks gain ground as investors shrug off Mideast concerns

NEW YORK, New York - U.S. stocks made strong gains on Monday, brushing off concerns Donald Trump's surprise ambush of Iranian nuclear...

U.S. bombs Iran nuclear sites, investors eye oil and safe havens

NEW YORK CITY, New York: The U.S. bombing of Iranian nuclear sites has cast a shadow over global markets, with investors bracing for...

Farmers exploit loophole in Amazon soy deal to clear rainforest

SANTAREM, Brazil: As Brazil cements its position as the world's top soy exporter, a new wave of deforestation is spreading across the...

Europe eases rates as Fed holds and Trump threatens tariffs

ZURICH, Switzerland: A wave of central banks across Europe surprised markets last week by lowering interest rates, responding to easing...

Federal Reserve chief weighs next move as economic outlook wavers

WASHINGTON, D.C.: The U.S. economy is performing reasonably well, but Federal Reserve Chair Jerome Powell faces a difficult decision...

TikTok gets US reprieve as Trump grants 90-day extension

WASHINGTON, D.C.: President Donald Trump has granted TikTok another reprieve, extending the deadline for its Chinese parent company,...