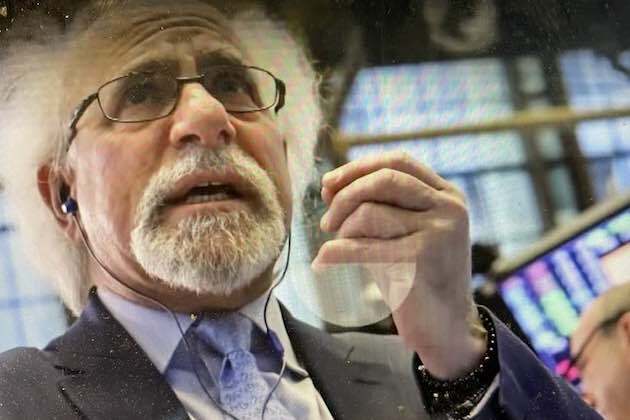

Wall Street on edge, industrials gain while techs slide

Lola Evans

29 Apr 2025, 01:38 GMT+10

- “Recent days have brought indications of some easing in U.S.-China trade tensions."

- “This is mostly talk, for now, and we remain skeptical that there will be enough concrete momentum in trade discussions to sidestep a U.S. recession.”

- Treasury Secretary Scott Bessent played down the confusion over whether the U.S. and China are currently in negotiations, with Donald Trump saying talks are taking place, while China is insisting they are not.

NEW YORK, New York - Uncertainty about trade negotiations between the United States and China kept investors and traders on edge Monday as the week opened with the key industrial indices making only modest gains, while tech stocks fell.

"Recent days have brought indications of some easing in U.S.-China trade tensions, with both sides chipping away at the unsustainable tariff rates implemented earlier this month and the U.S. signaling some intent to deescalate," Barclays economist Jonathan Millar said in a note to clients. "This is mostly talk, for now, and we remain skeptical that there will be enough concrete momentum in trade discussions to sidestep a U.S. recession."

Treasury Secretary Scott Bessent played down the confusion over whether the U.S. and China are currently in negotiations, with Donald Trump saying talks are taking place, while China is insisting they are not. "I believe that it's up to China to de-escalate, because they sell five times more to us than we sell to them, and so these 120 percent, 145 percenttariffs are unsustainable," the treasury secretary told CNBC's "Squawk Box," Monday.

Here's a breakdown of Monday's key index movements:

U.S. Markets

-

S&P 500: 5,528.75 (+3.54, +0.06 percent) – Hits fresh record high in muted rally

-

Dow Jones Industrial Average: 40,227.59 (+114.09, +0.28 percent) – Led by financial and industrial stocks

-

NASDAQ Composite: 17,366.13 (−16.81, −0.10 percent) – Tech stocks weigh as megacaps stall

Key Takeaways

-

Dow Leads U.S. Gains: The 30-stock index extended its winning streak, supported by strong performances from Goldman Sachs (GS) and Caterpillar (CAT).

-

Nasdaq Dips: Tech giants like Nvidia (NVDA) and Tesla (TSLA) faced mild profit-taking after recent rallies.

Market Drivers

-

Fed Speculation: Investors remain cautious ahead of Friday's PCE inflation data, which could influence Fed rate-cut timing.

-

Sector Rotation: Money flowed into defensive sectors (utilities, healthcare) amid light summer trading volumes.

-

Earnings Watch: Focus shifts to Micron (MU) and FedEx (FDX) reports later this week for tech and transport sector cues.

Dollar Mixed as Euro and Pound Gain, Yen Rises Sharply in Monday's FX Trading

The foreign exchange market saw a split performance on Monday, with the U.S. dollar weakening against European currencies and losing ground against the Japanese yen. Here are the key movements:

Major Currency Pairs

-

EUR/USD (Euro/US Dollar): 1.1420 (+0.52 percent) – Euro strengthens amid improved risk sentiment

-

GBP/USD (British Pound/US Dollar): 1.3430 (+0.95 percent) – Sterling leads gains as UK economic data supports

-

USD/JPY (US Dollar/Japanese Yen): 142.08 (−1.08 percent) – Yen rallies on potential Bank of Japan policy shift speculation

-

USD/CHF (US Dollar/Swiss Franc): 0.8205 (−0.78 percent) – Franc benefits from safe-haven demand

-

AUD/USD (Australian Dollar/US Dollar): 0.6429 (+0.56 percent) – Commodity-linked Aussie climbs

-

NZD/USD (New Zealand Dollar/US Dollar): 0.5971 (+0.28 percent) – Kiwi edges higher in risk-on trade

-

USD/CAD (US Dollar/Canadian Dollar): 1.3833 (−0.10 percent) – Loonie steady as oil prices hold firm

Key Takeaways

-

Euro & Pound Outperform: The EUR and GBP gained over 0.5 percent and 0.95 percent, respectively, against the USD, supported by stronger regional economic signals.

-

Yen Surges: The JPY was the day's biggest mover, with USD/JPY dropping 1.08 percent amid speculation of tighter monetary policy from the Bank of Japan.

-

Commodity Currencies Rise: The AUD and NZD advanced as risk appetite improved, while the CAD held steady despite weaker oil prices.

Market Drivers

-

BOJ Policy Watch: Traders are closely monitoring whether Japan will adjust its ultra-loose monetary stance.

-

Fed Rate Expectations: The dollar's broader weakness reflects fading bets on additional Fed rate hikes.

-

European Resilience: The eurozone's improving economic outlook continues to bolster the EUR.

Global Markets Close Mixed on Monday; Sensex Surges Over 1 Percent

Global stock markets delivered a mixed performance on Monday, with several major indices posting modest gains while others edged lower. Here's a roundup of Monday's closing figures:

Canada

-

S&P/TSX Composite: 24,798.59 (+88.08, +0.36 percent) – Outperforms U.S. peers on energy and materials boost

UK and Europe

-

FTSE 100 (UK): 8,417.34 (+2.09, +0.02 percent)

-

DAX (Germany): 22,271.67 (+29.22, +0.13 percent)

-

CAC 40 (France): 7,573.76 (+37.50, +0.50 percent)

-

EURO STOXX 50: 5,170.49 (+16.37, +0.32 percent)

-

Euronext 100: 1,504.99 (+3.80, +0.25 percent)

-

BEL 20 (Belgium): 4,332.93 (+26.88, +0.62 percent)

Asia-Pacific

-

Hang Seng (Hong Kong): 21,971.96 (-8.78, -0.04 percent)

-

STI (Singapore): 3,811.80 (-11.98, -0.31 percent)

-

S&P/ASX 200 (Australia): 7,997.10 (+28.90, +0.36 percent)

-

All Ordinaries (Australia): 8,203.90 (+28.80, +0.35 percent)

-

S&P/NZX 50 (New Zealand): 12,098.89 (+81.05, +0.67 percent)

-

Nikkei 225 (Japan): 35,839.99 (+134.25, +0.38 percent)

-

KOSPI (South Korea): 2,548.86 (+2.56, +0.10 percent)

-

TWSE (Taiwan): 20,034.41 (+161.68, +0.81 percent)

-

SSE Composite (China): 3,288.41 (-6.65, -0.20 percent)

Southeast Asian Markets

-

S&P BSE Sensex (India): 80,218.37 (+1,005.84, +1.27 percent) – A standout performer

-

IDX Composite (Indonesia): 6,722.97 (+44.05, +0.66 percent)

-

FTSE Bursa Malaysia KLCI: 1,521.59 (+12.39, +0.82 percent)

Middle East

-

TA-125 (Israel): 2,548.85 (-8.58, -0.34 percent)

-

EGX 30 (Egypt): 32,015.00 (+159.90, +0.50 percent)

Africa

-

Top 40 USD Net TRI (South Africa): 4,785.62 (+10.41, +0.22 percent)

Key Takeaways

-

India's Sensex led gains with a strong 1.27 percent jump.

-

European markets saw moderate advances, with France's CAC 40 up 0.50 percent.

-

Asian markets were mixed, with Taiwan and Malaysia rising over 0.80 percent, while China and Singapore dipped slightly.

Investors remain cautious ahead of key economic data and central bank policy decisions later in the week.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionUS lawmakers subpoena Chinese telecom giants over security fears

WASHINGTON, D.C.: U.S. lawmakers are turning up the heat on China's biggest telecom firms, issuing subpoenas to compel their cooperation...

BMW to integrate DeepSeek AI in China models this year

SHANGHAI, China: BMW is set to incorporate artificial intelligence from Chinese startup DeepSeek into its upcoming vehicle models in...

Cathay Pacific braces for cargo slowdown amid China-US trade tensions

Hong Kong: Cathay Pacific Airways is preparing for a slowdown in air cargo traffic between China and the United States as new trade...

Toyota’s Hino and Mitsubishi Fuso near merger deal

TOKYO, Japan: Toyota's Hino Motors and Daimler Truck's Mitsubishi Fuso are edging closer to a long-awaited merger of their truck operations,...

China’s automobile exports jump 16% in early 2024

BEIJING, China: China's automobile exports rose sharply in the first quarter of 2024, with 1.54 million vehicles shipped abroad, marking...

UK and New Zealand to boost defence ties

LONDON, U.K.: British Prime Minister Keir Starmer and New Zealand Prime Minister Christopher Luxon decided to strengthen their countries'...

Business

SectionWall Street on edge, industrials gain while techs slide

NEW YORK, New York - Uncertainty about trade negotiations between the United States and China kept investors and traders on edge Monday...

US new home sales jump as buyers seize lower rates in March

WASHINGTON, D.C.: Sales of new single-family homes in the U.S. rose more than expected in March as buyers rushed to take advantage...

BMW to integrate DeepSeek AI in China models this year

SHANGHAI, China: BMW is set to incorporate artificial intelligence from Chinese startup DeepSeek into its upcoming vehicle models in...

Cathay Pacific braces for cargo slowdown amid China-US trade tensions

Hong Kong: Cathay Pacific Airways is preparing for a slowdown in air cargo traffic between China and the United States as new trade...

Nissan accelerates strategy in China to compete with global rivals

SHANGHAI, China: Nissan is making a fresh push to regain its footing in China with a US$1.4 billion investment and a pledge to speed...

Toyota’s Hino and Mitsubishi Fuso near merger deal

TOKYO, Japan: Toyota's Hino Motors and Daimler Truck's Mitsubishi Fuso are edging closer to a long-awaited merger of their truck operations,...