U.S. dollar weighed down by tariffs, stock market woes

Lola Evans

11 Mar 2025, 01:25 GMT+10

- The dollar declined by 0.76 percent against the Japanese yen, settling at 147.34.

- The euro edged higher against the dollar, trading at 1.0824, marking a modest increase of 0.03 percent.

- The Australian dollar decreased by 0.40 percent against the U.S. dollar, trading at 0.6279.

NEW YORK CITY, New York - The global foreign exchange market experienced notable shifts on Monday, influenced by escalating trade tensions and growing concerns over a potential U.S. recession. The U.S. dollar weakened against major currencies, reflecting investors' apprehensions about the economic outlook.

Key Currency Movements:

-

EUR/USD (Euro/US Dollar): The euro edged higher against the dollar, trading at 1.0824, marking a modest increase of 0.03 percent.

-

USD/JPY (US Dollar/Japanese Yen): The dollar declined by 0.76 percent against the yen, settling at 147.34.

-

USD/CAD (US Dollar/Canadian Dollar): The greenback strengthened against the Canadian dollar, with the pair trading at 1.4445, an increase of 0.59 percent.

-

GBP/USD (British Pound/US Dollar): The British pound weakened by 0.30 percent against the dollar, trading at 1.2871.

-

USD/CHF (US Dollar/Swiss Franc): The dollar saw a slight uptick against the Swiss franc, trading at 0.8813, up 0.21 percent.

-

AUD/USD (Australian Dollar/US Dollar): The Australian dollar decreased by 0.40 percent against the U.S. dollar, trading at 0.6279.

-

NZD/USD (New Zealand Dollar/US Dollar): The New Zealand dollar edged down by 0.13 percent against the U.S. dollar, trading at 0.5697.

Market Influences:

The currency market's movements were largely attributed to:

-

Trade Tensions: Ongoing global trade disputes, particularly involving the United States, have heightened market uncertainty. The recent imposition of tariffs has led to concerns about a potential slowdown in global economic growth.

-

Recession Fears: Investors are increasingly wary of a possible U.S. recession, influenced by volatile tariff policies and economic indicators suggesting a slowdown. This sentiment has driven a shift towards safer assets, benefiting currencies like the Japanese yen and Swiss franc.

-

Equity Market Declines: Significant sell-offs in global equity markets, including a sharp drop in U.S. stock indices, have further fueled risk aversion, impacting currency valuations.

Outlook:

As trade negotiations continue and economic data releases loom, the forex market is expected to remain volatile.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionChina targets 5 percent growth for 2025 amid economic uncertainty

BEIJING, China: China has set an economic growth target of around five percent for 2025, signaling efforts to stabilize the economy...

Man disqualified from driving for next 92 years to face Bathurst court

BATHURST, NSW, Central West, Australia - A man who has been disqualified from holding a driver's license for the next ninety-two years...

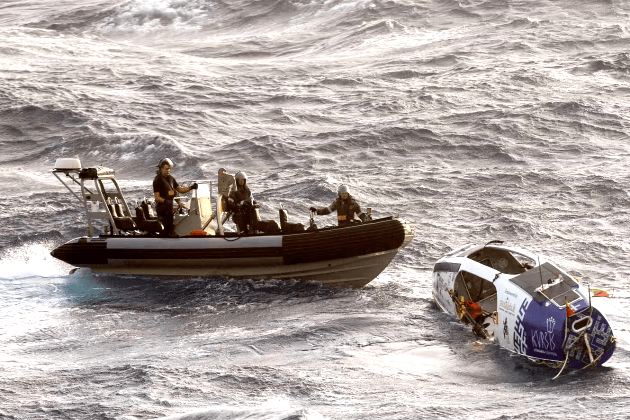

Australian warship rescues Lithuanian adventurer in Coral Sea

MELBOURNE, Australia: An Australian warship rescued Lithuanian adventurer Aurimas Mockus this week after he became stranded in the...

US aircraft carrier in South Korea after North Korea's missile tests

SEOUL, South Korea: A U.S. aircraft carrier reached South Korea over the weekend, shortly after North Korea test-fired cruise missiles...

Chinese nationals accused of hacking US government, newspapers to get data on dissidents

(CN) - The Justice Department announced Wednesday indictments against a dozen Chinese nationals, claiming they worked to steal data...

Trump could visit China next month SCMP

The US president is reportedly interested in hammering out a trade deal US President Donald Trump and Chinese President Xi Jinping...

Business

SectionU.S. dollar weighed down by tariffs, stock market woes

NEW YORK CITY, New York - The global foreign exchange market experienced notable shifts on Monday, influenced by escalating trade tensions...

US: Refilling oil reserve fully will cost $20 billion, take years

WASHINGTON, D.C.: The U.S. Energy Department estimates it will take US$20 billion and several years to refill the Strategic Petroleum...

BP CEO’s pay drops to 5.4 million pounds in 2024

LONDON, U.K.: British Petroleum CEO Murray Auchincloss saw his pay package drop to 5.4 million pounds (US$6.95 million) in 2024, down...

DHL to cut 8,000 German jobs in largest layoff in 20 years

BONN, Germany: DHL plans to cut 8,000 jobs in Germany this year, marking its most significant domestic workforce reduction in at least...

China targets 5 percent growth for 2025 amid economic uncertainty

BEIJING, China: China has set an economic growth target of around five percent for 2025, signaling efforts to stabilize the economy...

SpaceX denies plans to take over FAA telecom contract

WASHINGTON, D.C.: Elon Musk's company SpaceX said this week that its Starlink satellite unit is not trying to take over any Federal...