Yuan outpacing euro Reuters

RT.com

21 Nov 2023, 15:44 GMT+10

Low interest rates have sparked a global rush to borrow in China, the outlet has said

Global companies are reaping record profits through yuan-denominated bonds and are borrowing heavily from Chinese lenders at low interest rates, at a time when the cost of using Western banks is skyrocketing, Reuters reported on Friday.

According to the news agency, international companies and banks are raising record amounts of cash through Chinese 'panda' and 'dim sum' bonds denominated in yuan.

"While the fundamental story is not compelling for Chinese investors looking for growth, the depreciation of the yuan as well as the rate cuts result in a much cheaper cost of borrowing," said Fiona Lim, senior FX strategist at Maybank.

The uptick in China's borrowing market has made the yuan the world's second-biggest trade funding currency, ahead of the euro. The development reflects Beijing's ambitions to boost the yuan's share in global funding, Reuters added.

According to the report, the National Bank of Canada raised 1 billion yuan ($138.6 million) in October from the sale of a three-year panda bond at a coupon of 3.2%, while domestic interest rates stood at 4.5%.

The People's Bank of China (PBOC) has been encouraging banks to lend to international companies and has allowed broader use of the yuan outside the country, the outlet said.

"Panda bonds are steadily promoting the renminbi's function as a funding currency," the PBOC stated in a report last month.

The Chinese yuan showed record gains in September as its share in international payments surged to 5.8%, up from 3.9% at the beginning of the year, outperforming the euro for the first time, data from SWIFT revealed.

The growing share of the yuan in cross-border transactions reflects China's trend of shifting away from the US dollar, as well as Beijing's efforts to promote the use of its national currency.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionHong Kong's economy grows 3.1 percent in Q1, marks ninth straight gain

HONG KONG: Hong Kong's economy grew by 3.1 percent in the first quarter of this year compared to the same period last year, according...

Chinese homeowners slash prices amid resale glut

BEIJING, China: Homeowners in China are slashing prices to attract buyers as a growing number of resale properties flood the market....

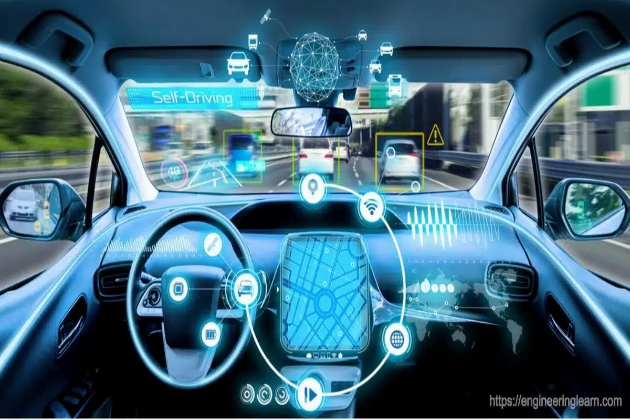

Toyota partners with Waymo to advance self-driving car tech

TOKYO, Japan: Toyota is taking a fresh step toward autonomous driving by teaming up with Waymo to co-develop new vehicle platforms...

China's factory activity shrinks at fastest pace in over a year

BEIJING, China: China's manufacturing sector lost steam in April, with activity shrinking at the fastest pace in over a year, as new...

Australian police and partners smashing drug cartels

Every day, police across Australia investigate thousands of incidents—any one of which could unlock a major case on the other side...

Australia inflation hits 3-year low, boosting rate cut hopes

SYDNEY, Australia: A key measure of inflation in Australia has cooled to its lowest level in three years, lending weight to expectations...

Business

SectionKimberly-Clark to invest $2 billion in US manufacturing expansion

IRVING, Texas: Kimberly-Clark, the maker of Kleenex tissues and Huggies diapers, announced this week it will invest US$2 billion over...

Hong Kong's economy grows 3.1 percent in Q1, marks ninth straight gain

HONG KONG: Hong Kong's economy grew by 3.1 percent in the first quarter of this year compared to the same period last year, according...

U.S. stocks extend gains after FOMC leaving rates untouched

NEW YORK, New York - U.S. stocks advanced on Wednesday while the U.S. dollar made across-the-board gains after the Federal Reserve...

JetBlue pilots oppose new US airline partnership plan

LONG ISLAND CITY, New York: JetBlue Airways' plan to strike a domestic partnership with another U.S. airline is drawing sharp resistance...

Shell beats estimates with $5.58 billion Q1 profit despite 28% drop

LONDON, U.K.: Shell reported a better-than-expected first-quarter profit of US$5.58 billion on May 2, down 28 percent from a year earlier...

Thailand cuts 2025 tourist forecast to 36.5 million

BANGKOK, Thailand: Thailand's finance ministry has revised its projection for foreign tourist arrivals this year, lowering the estimate...