U.S. dollar rises after ECB rates hike

Xinhua

15 Sep 2023, 02:48 GMT+10

NEW YORK, Sept. 14 (Xinhua) -- The U.S. dollar advanced in late trading on Thursday, as the European Central Bank (ECB) announced a 10th consecutive hike in its main interest rate.

The dollar index, which measures the greenback against six major peers, increased 0.58 percent to 105.3816 in late trading, hitting its highest level in six months.

The ECB's rate rises have hauled its main deposit facility from -0.5 percent in June 2022 to a record 4 percent. The ECB move on Thursday also has taken the interest rates on its main refinancing operations and marginal lending facility 25 basis points higher, to 4.5 percent and 4.75 percent, respectively.

In a statement, the ECB indicated that further hikes may be off the table for now. "Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target."

"The Governing Council's future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary," it added.

The euro fell sharply after the announcement. In late New York trading, the euro was down to 1.0636 U.S. dollars from 1.0732 dollars in the previous session, and the British pound was down to 1.2402 U.S. dollars from 1.2486 dollars.

During the week ending Sept. 9, claims for state unemployment benefits rose by 3,000 to 220,000 in the United States, the U.S. Bureau of Labor Statistics (BLS) said Thursday. The four-week moving average of claims fell 5,000 to 224,500 in the latest week, which was the lowest level since late February.

"Layoffs remain low and, for now, there is no sign that businesses are shedding workers in large numbers in response to restrictive monetary policy that is aimed at weakening demand and economic activity," said Rubeela Farooqi, chief U.S. economist at High Frequency Economics.

Despite the U.S. economic data, views for the Federal Reserve remained largely intact. Expectations that the U.S. central bank will likely hold rates steady at its Sept. 19-20 policy meeting are at 97 percent, according to CME's FedWatch Tool on Thursday.

In late New York trading, the U.S. dollar bought 147.4410 Japanese yen, lower than 147.45 Japanese yen of the previous session. The U.S. dollar increased to 0.8962 Swiss francs from 0.8934 Swiss francs, and it fell to 1.3509 Canadian dollars from 1.3564 Canadian dollars. The U.S. dollar increased to 11.2022 Swedish krona from 11.1379 Swedish krona.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionDeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Western Sydney raid results in seizure of $25 Million in drugs

SYDNEY, NSW, Australia - , Australian Federal Police (AFP) have shut down a secret drug lab in Sydney's west and seized more than 100kg...

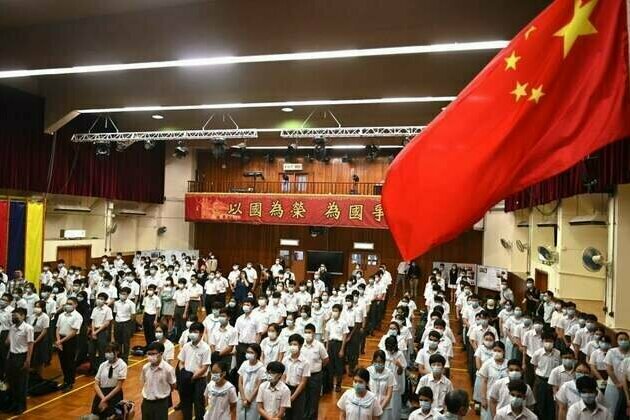

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

"Will hear from President and his trade team soon when it comes to India": White House spokesperson

By Reena Bhardwaj Washington DC [US], July 1 (ANI): White House Press Secretary Karoline Leavitt on Monday (US local time) confirmed...

UAE supplies 40.8 pc of Japan's oil imports in May

Tokyo [Japan], June 30 (ANI/WAM): The United Arab Emirates was Japan's top crude oil supplier in May 2025, providing Tokyo with 30.42...

QUAD nations launch 'QUAD at Sea Ship Observer Mission', deepening maritime cooperation in Indo-Pacific

New Delhi [India], June 30 (ANI): In a landmark step towards deepening maritime cooperation in the Indo-Pacific, the Coast Guards of...

Business

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...