Russian companies find new ways to service debt Bloomberg

RT.com

25 Jan 2023, 11:43 GMT+10

Some firms have opted to substitute their eurobonds to ruble debt, the outlet has found

Russia's biggest companies - including unsanctioned ones - are "bypassing Wall Street" for servicing their outstanding debt following Western sanctions that broadly disrupted critical financial operations needed to keep bonds functioning, Bloomberg reported on Monday.

Restrictions have complicated a large number of financial processes for servicing bonds even if a borrower hasn't been targeted by sanctions, the outlet said. Companies and investors now search for alternatives, including swaps, buybacks and direct payments to bondholders.

Some companies like fertilizer producer Uralkali, miner Norilsk Nikel and metals giant Metalloinvest have opted to change bond documentation and pay the debt directly to investors in rubles, the outlet said. The country's energy major Gazprom and one of the world's largest steel producers, Magnitogorsk Iron & Steel Works PJSC, have swapped some of their eurobonds for ruble debt.

Gazprom Deputy Chairman Famil Sadygov told Bloomberg that replacement bonds were "the most reliable way" to service debt given the restrictions on financial infrastructure. He noted that holdings of ten of the bonds have already been substituted and another 12 will be replaced by the end of March, adding that Gazprom pays coupons on both the swapped Russian bonds and the remaining international bonds.

Following EU sanctions, Europe's two major central depositories - Euroclear and Clearstream - have only been processing transactions verified by paying agents. The clearing houses have been reluctant to process corporate actions, forcing companies to find ways to bypass European depositories.

Companies have realized that sanctions have disrupted so many processes needed to keep bonds that it's become necessary to take them out of the market.

A portfolio manager at Armbrok investment company, Dmitry Dorofeev, told Bloomberg that "in a couple of months everything is going to be bought out" by local investors, adding that "Russian companies will replace bonds and return to Russia."

Russia's international corporate bond market declined by about $12.7 billion from $85.6 billion since the imposition of Ukraine-related sanctions on Moscow, according to the outlet.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionBeijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

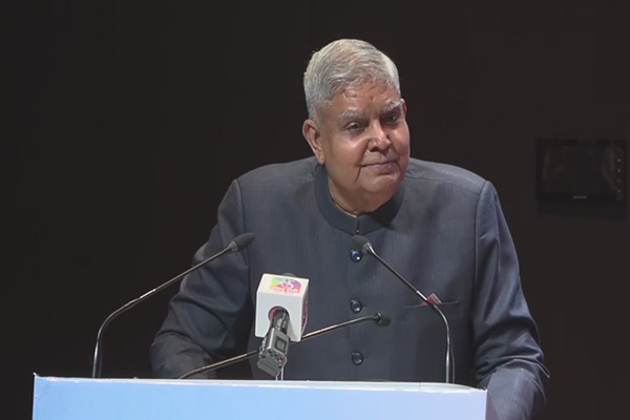

Industry must promote gender and caste diversity in leadership: Jagdeep Dhankhar

New Delhi [India], July 11 (ANI): Vice President Jagdeep Dhankhar urged Indian businesses to expand globally, not only in markets but...

The peace deal that put women first: What Colombia taught the world

Representatives of women's organizations and networks that were part of the first delegation of gender experts at the talks in Havana...

USWNT legend Tobin Heath announces retirement

(Photo credit: Joe Nicholson-Imagn Images) Tobin Heath, a two-time Olympic gold medalist and World Cup champion with the United States...

"Seeing good progression in my bowling...": Nitish Kumar Reddy on working with coach Morne Morkel

London [UK], July 11 (ANI): Following a solid day with the ball, which included two prized wickets of openers Ben Duckett and Zak Crawley,...

"We'll get to know next morning...": Indian all-rounder Nitish Kumar's update on Pant's finger injury

London [UK], July 11 (ANI): Following the end of the first day's play during the third Test against England at Lord's, Indian all-rounder...

Business

SectionGold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...