Indian stocks slump on global monetary policy tightening; Rupee at new low

ANI

23 Sep 2022, 10:48 GMT+10

New Delhi [India], September 23 (ANI): Indian stocks extended their losses from the previous session and declined further on Friday morning following the latest policy rates hike by the US Federal Reserve in its fight against high inflation.

At 10.05 am, Sensex and Nifty traded in the 0.8-0.9 per cent range.

Further tightening of monetary policy in the US essentially means that investors will have a tendency to move to the US markets for better and stable returns.

Meanwhile, Rupee tasted yet another lifetime low on Friday morning after the US dollar index strengthened to a two-decade high this week, on hopes that demand for safe-haven currency such as the dollar would pick up.

This morning, the Rupee opened 25 paise lower to touch a record low of 81.09 versus the US dollar, against Thursday's close of 80.86. Yesterday's depreciation was the biggest single-day fall for the rupee since February 24.

The US Federal Reserve had raised the repo rate by 75 basis points -- which is the third consecutive hike of the same magnitude, in line with expectations. The Fed also hinted that more rate hikes were coming and that these rates would stay elevated until 2024.

The US central bank seeks to achieve maximum employment and inflation at the rate of 2 per cent over the long run and it anticipates that the ongoing hikes in the target range will be appropriate. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Consumer inflation in the US though declined marginally in August to 8.3 per cent from 8.5 per cent in July but is way above the 2 per cent goal.

India's forex reserves are at two-year low. The reserves have dropped by almost USD 80 billion since the escalation of the Russia-Ukraine tensions into war earlier this yearIndia's forex reserves have been consistently dropping for the past few month, on account of RBI's likely intervention in the market to defend the depreciating rupee.

Typically, the RBI intervenes in the market through liquidity management, including through the selling of dollars, with a view to preventing a steep depreciation in the rupee.

A depreciation in the rupee typically makes imported items costlier.

"The Dollar Index may continue with its positive bias as the US Fed decided to raise interest rate by 75 bps, for a third consecutive month and signalled that it would continue to lift rates this year at a most rapid pace to combat inflation, which is running hot," said ICICI Securities. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Western Sydney raid results in seizure of $25 Million in drugs

SYDNEY, NSW, Australia - , Australian Federal Police (AFP) have shut down a secret drug lab in Sydney's west and seized more than 100kg...

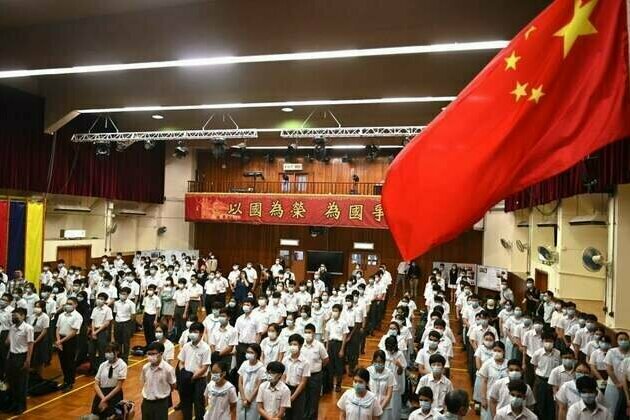

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Army's cycling expedition covers 312 km from Nyoma to Galwan in tribute to fallen "bravehearts"

Leh (Ladakh) [India], July 2 (ANI): GOC Trishul Division's Galwan Cycling Expedition team covered a distance of 312 km from Nyoma to...

Business

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...