U.S. dollar advances on continuous rise of inflation

Xinhua

25 Nov 2021, 05:19 GMT+10

NEW YORK, Nov. 24 (Xinhua) -- The U.S. dollar gained ground against most of a basket of currencies in late trading on Wednesday amid rising inflation pressure and expectation of an earlier hike of interest rate by the Federal Reserve.

The dollar index, which measures the greenback against six major peers, rose 0.39 percent at 96.8639 in late trading.

U.S. personal consumption expenditure price index in October grew 0.6 percent month on month, higher than 0.4 percent of expansion in the previous month, according to the data issued by the U.S. Department of Commerce on Wednesday morning.

The index posted year-on-year growth of 5 percent in October, up from 4.4 percent in September, according to the U.S. Department of Commerce.

The Federal Reserve is expected to raise benchmark interest rates as early as mid-2022 with some calling for faster tapering of the bond purchasing program.

San Francisco Fed President Mary Daly on Wednesday said she certainly sees a case to be made for speeding up the tapering of Fed's bond purchasing program.

"If things continue to do what they've been doing, then I would completely support an accelerated pace of tapering," said Daly in an interview with Yahoo Finance.

The Fed has as much as 91.2 percent probability of raising benchmark interest rate by at least 25 basis points by the scheduled meeting of the Federal Open Market Committee on June 15, 2022, according to the FedWatch Tool on the website of CME Group.

The probability for at least 25 basis points of interest rate hike by then stood at 73.5 percent a day ago, according to the FedWatch Tool.

In late New York trading, the euro fell to 1.1199 dollars from 1.1250 dollars in the previous session, and the British pound fell to 1.3323 dollars from 1.3381 U.S. dollars in the previous session. The Australian dollar fell to 0.7192 dollar from 0.7223 dollar.

The U.S. dollar bought 115.43 Japanese yen, higher than 115.06 Japanese yen of the previous session. The U.S. dollar was up to 0.9341 Swiss franc from 0.9332 Swiss franc, and it fell to 1.2671 Canadian dollars from 1.2682 Canadian dollars.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Japan Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Japan Herald.

More InformationAsia Pacific

SectionTrump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

UN Demands End to Myanmar Violence as Junta’s Election Plans Risk Further Instability

Nearly three months after a devastating earthquake struck Myanmar, the country remains trapped in a deepening crisis, compounded by...

Fresh IVF error raises alarm over clinic safety and oversight

MELBOURNE, Australia: A second embryo mix-up in just two months has pushed one of Australia's largest IVF providers back into the spotlight,...

Australian PM rejects US pressure to ease biosecurity rules

SYDNEY, Australia: Australia will not ease its strict biosecurity rules during trade talks with the United States, Prime Minister Anthony...

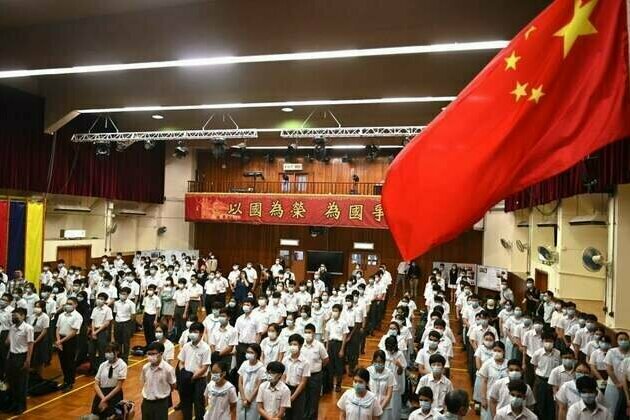

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Business

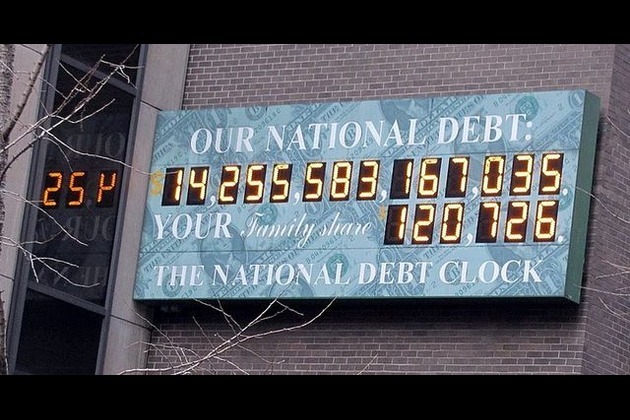

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...